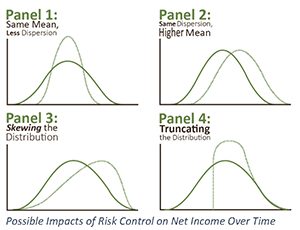

This can be a busy time of year for many farmers and ranchers. Calving season may be in full swing, feeding and other chores are carried out in cold weather, and tax returns are completed and filed. In addition, there are a plethora of meetings, conferences and other educational opportunities. Finalizing last year’s financial records in order to file tax reports and analyze the business is not a fun task to consider. Some farmers and ranchers are required to file their tax returns by March 1, while others have until a later date. Filing deadlines depend, in part, on business form (sole proprietorship, partnership, etc.) and any estimated taxes paid throughout the year. . . click here to read more.

Bought to you by:

Progressive Cattle and The RightRisk Team