| |

Risk Concepts |

|

|

Sole Proprietorship |

|

|

|

|

|

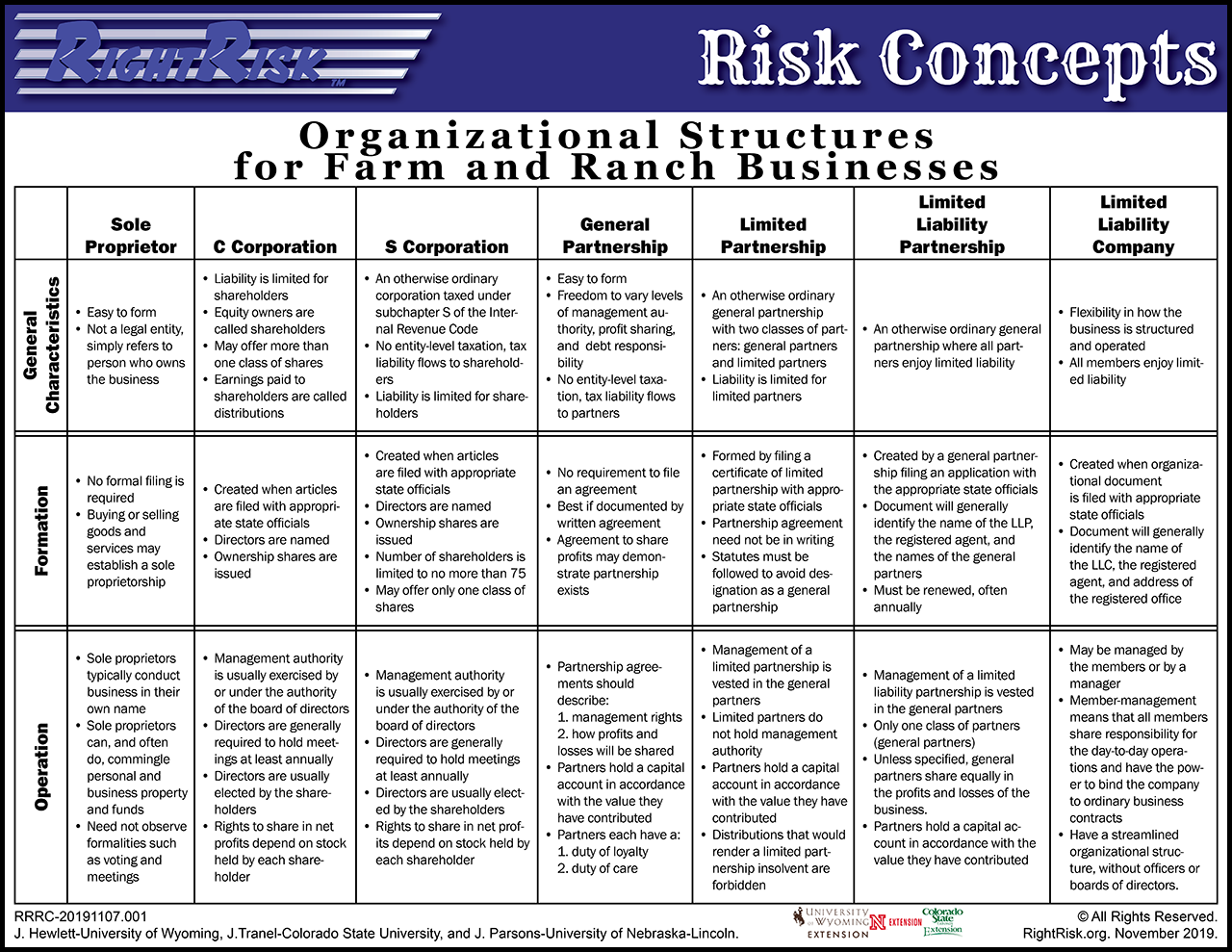

Sole Proprietorship The sole proprietorship is the simplest business form under which one can operate a business. The sole proprietorship is not a legal entity. It simply refers to a person who owns the business and is personally responsible for its debts. A sole proprietorship can operate under the name of its owner or it can do business under a fictitious name. |

|

|

|

|

C Corporation

The corporation (C Corporation) is probably the form of business entity which comes most readily to mind for most people. It is formed by filing articles of incorporation with the appropriate state officials. A corporation may also have written bylaws that will govern day-to-day operations. The equity owners of a corporation are called shareholders who, in their capacity as shareholders, have only very basic voting rights. They elect the managers of the corporation (called directors), are entitled to vote on most decisions that would require an amendment to the articles of incorporation, and must approve certain fundamental transactions involving a change in structure of the corporation. Generally, any legal person (including individuals, associations of persons, and legal entities) can be a corporate shareholder. In most states, investment in a corporation can be in the form of property, cash, or services. |

|

|

|

|

S Corporation The S corporation is an otherwise ordinary corporation which is eligible for and has elected to be taxed under subchapter S of the Internal Revenue Code. For state law purposes, it is formed like any other corporation, and the provisions of the general business corporation statutes apply. It is formed by filing articles of incorporation with the appropriate state officials. A corporation may also have written bylaws that will govern how the corporation is run on a day-to-day basis. The benefit of electing subchapter S status is that there is no entity level tax. Items of income and loss flow through to the shareholders and are taxed only at the shareholder level. A disadvantage of subchapter S status is less flexibility than C corporations. An S corporation can have no more than 75 shareholders. If shares are owned by more than 75 investors, the corporation loses its status as an S corporation and becomes taxable as a C corporation. Moreover, with certain limited exceptions, only individuals can be shareholders in an S corporation. Finally, an S corporation can have only one class of shares. This substantially limits the corporations? ability to structure different rates of return for different investors. |

|

|

|

|

General Partnership A general partnership is an association of two or more people who agree to carry on a business as co-owners for a profit. The partnership form of enterprise has been around for many years and is familiar to most legal, accounting, and other professionals. As such, there is a high familiarity factor and there are a number of resources which can be relied upon for forms and research. The general partnership is a very flexible form of enterprise. State partnership statutes provide default rules pertaining to management rights and the calculation of each partner?s share of profits and losses. However, the partners in a partnership agreement are generally free to change these default provisions by agreement. For example, absent agreement to the contrary, all partners have equal management authority and are entitled to share equally in the profits and losses of the enterprise. However, it is not at all unusual to see a general partnership with a managing partner or executive committee with full management powers and with allocations of profit and loss among the partners that are not equal |

|

|

|

|

Limited Partnership A limited partnership is a partnership with at least one general partner and at least one limited partner. It can only be formed by filing (usually with the Secretary of State) a written document which names the partners. The biggest distinctions between general and limited partnerships have to do with management rights and limited liability of the limited partners. The Revised Uniform Limited Partnership Act (RULPA) established this business structure and provides the regulations for creating, operating, and dissolving limited partnerships. |

|

|

|

|

Limited Liability Partnership A limited liability partnership (LLP) is a general partnership where all partners have limited liability as to other partner?s debts and liabilities due to misconduct. Except for a very few special provisions, it is subject to the same rules as a general partnership. There are four primary differences between LLPs and general partnerships: (1) they are formed in different ways; (2) they may have different requirements concerning insurance or financial responsibility; (3) specific steps may need to be taken in order to maintain LLP status; and (4) the liability of general partners is significantly different. Aside from these differences, the statutory rules applicable to general partnerships also apply to LLPs. All partners have equal management authority unless otherwise agreed, and even with agreement to the contrary, all partners retain apparent authority to bind the partnership by acts which are apparently carrying on the usual business of the partnership. |

|

|

|

|

|

Limited Liability Company The Limited Liability Company (LLC) is a creature of statute, recognized in each jurisdiction only by virtue of a legislative enactment in each state. There are three aspects of the LLC that are enticing for new businesses: (1) it can be taxed as a partnership, as a corporation (if such an election is granted by the I.R.S.), or as a disregarded entity if there is only a single member; (2) it is an extremely flexible form of business both in terms of options when creating the business and options about how it is to operate; and (3) it offers all members limited liability. |

|

|

|

|

Organizational Structures for Farm and Ranch Businesses The choice of organizational structure for your business will affect your liability, taxation, capitalization, decision making, agricultural government payments, gifting, and transfer options. Such a decision requires much thought and advice from professionals when choosing which business structure is most appropriate. |

|

|

|

|

| Send

comments or questions to information@rightrisk.org Copyright © 2002 RightRisk All Rights Reserved. |

|